Dividends are a portion of a company’s profits distributed to its shareholders as a return on their investment. While dividends reward investors, the law ensures fairness, timely distribution, and accountability by the company’s management.

The Companies Act, 2013 regulates dividend-related activities through:

- Section 123: Conditions for declaration of dividend

- Section 124: Treatment of unpaid or unclaimed dividend

- Section 127: Penalty for failure to distribute dividend

Together, these sections ensure financial discipline, shareholder protection, and penal consequences in case of non-compliance.

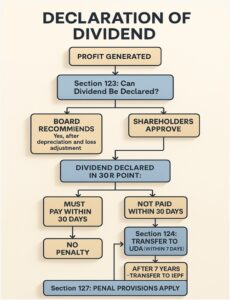

Declaration of Dividend

- Sources for declaring dividend:

-

- From current year’s profit after depreciation.

- From past reserves/profits (subject to rules).

- Out of both current and past profits.

- No declaration if company has losses:

- If company has incurred losses in current or previous years, dividend cannot be declared unless these losses are set off.

- Depreciation adjustment:

- Depreciation must be provided as per Schedule II before dividend is declared.

- Transfer to reserves (optional):

- Companies may voluntarily transfer a portion of profits to reserves.

- Dividend on equity shares only after:

- Paying dividend on preference shares (if any).

- Declaration only by the Board and approved in AGM:

- Board recommends, shareholders approve.

Illustrative Example:

If a company earns ₹10 Cr profit in FY 2024-25 and wants to declare dividend:

- Deduct depreciation (say ₹1 Cr).

- Adjust losses (say ₹2 Cr).

- Net profit for dividend = ₹7 Cr.

Unpaid Dividend Account

- Transfer to Unpaid Dividend Account (UDA):

- If dividend is not claimed/paid within 30 days, the company must transfer the amount to a separate bank account called the Unpaid Dividend Account within 7 days from expiry of 30 days.

- Disclosure on Website:

- Within 90 days of transfer to UDA, a statement must be placed on company’s website and MCA website containing:

- Names of shareholders

- Unclaimed amounts

- Within 90 days of transfer to UDA, a statement must be placed on company’s website and MCA website containing:

- Transfer to IEPF:

- Amounts lying in UDA for 7 years must be transferred to the Investor Education and Protection Fund (IEPF).

- Along with the dividend, shares on which dividend has not been claimed for 7 consecutive years must also be transferred to IEPF.

- Claim from IEPF:

- Shareholders can file Form IEPF-5 to claim their dividend and shares back.

🕒 Timeline Summary (Section 124):

| Timeline | Action |

| 30 days from declaration | Dividend must be paid |

| Next 7 days | Transfer unpaid to Unpaid Dividend Account |

| Next 90 days | Publish list of unclaimed holders on website |

| After 7 years | Transfer to IEPF (including shares) |

Punishment for Failure to Distribute Dividend

⚖️ When this section applies:

If dividend is declared in a general meeting and the company fails to pay it within 30 days, penal action is triggered.

🚫 Penalties:

- Every director (knowingly responsible) shall:

- Be punished with imprisonment up to 2 years AND

- Fine of ₹1,000 for every day of default (subject to maximum ₹1 lakh).

- Exemptions from penalty:

No penalty applies if failure to pay dividend is due to:- Operation of law (e.g. court stay)

- Shareholder instructions (e.g. wrong bank details)

- Dispute over ownership

- Adjustment of dividend against dues

- Other reason beyond control of company