Form 26QB is a return-cum-challan form for the payment of TDS for deductions made under Section 194-IA of the Income Tax Act, 1961 i.e. for TDS on Sale of Property.

I. Steps to fill form 26QB :

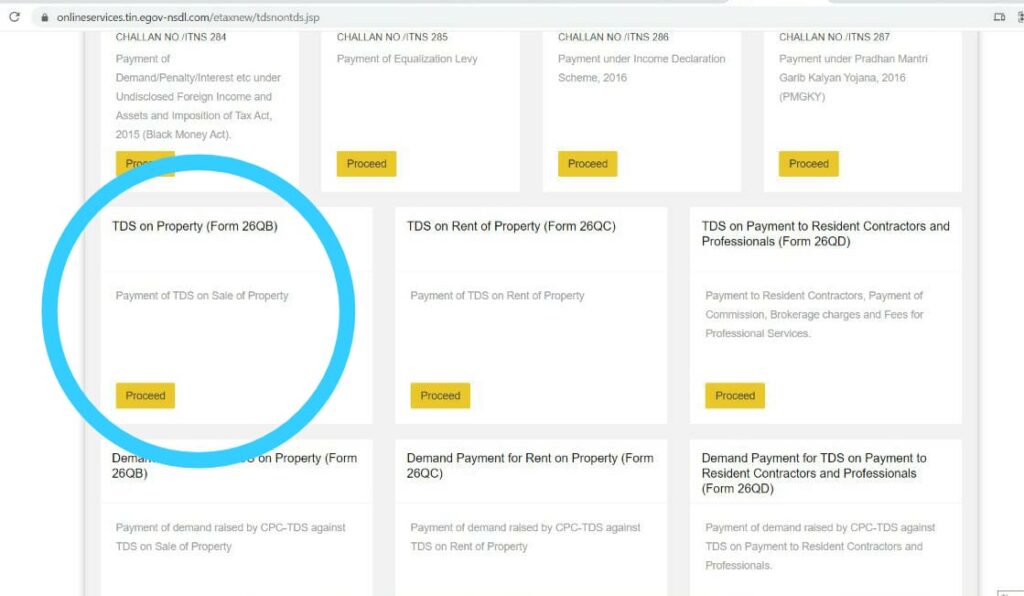

- Go to TIN NSDL website. Link to file form online is https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

2. Select Challan: Select the applicable challan as “TDS on Sale of Property”.

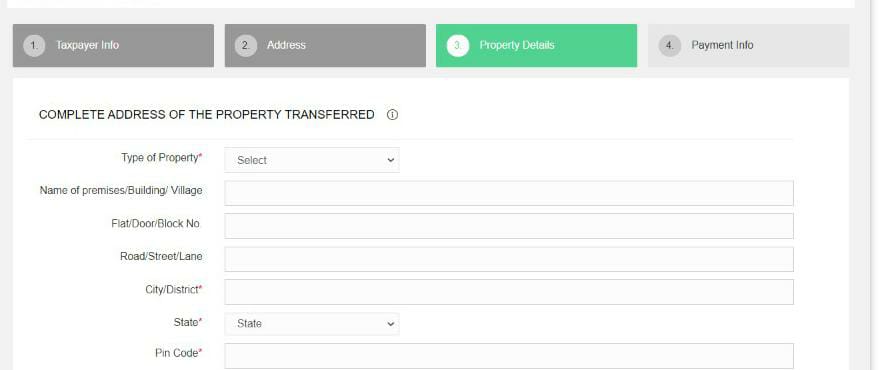

3. Details required for Form 26QB: Fill the complete form as applicable.(User should be ready with the following information while filling the form 26QB :

a) PAN of the seller & buyer

b) Communication details of seller & buyer– Communication address, Phone number, Email Id and if there are more than one buyer or seller.

c) Property details- Type of property and complete address of property

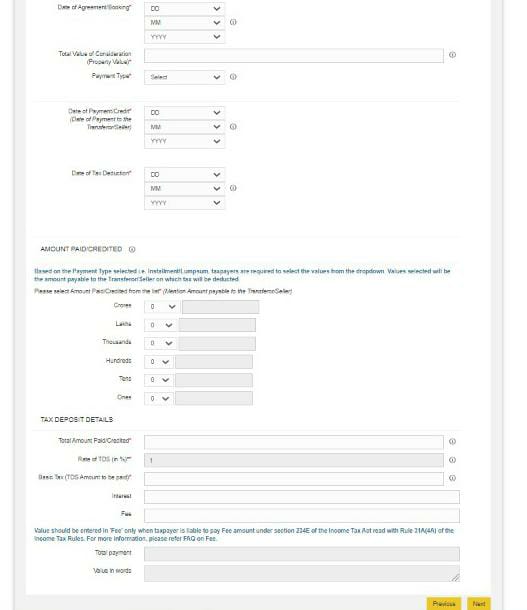

d) Amount paid/credited & tax deposit details- Date of Booking or agreement, Total Consideration, Payment Type (i.e. Lumpsum or instalment), date of Payment or credit, Date of TDS deduction, amount paid / credited, and TDS deducted on amount paid.

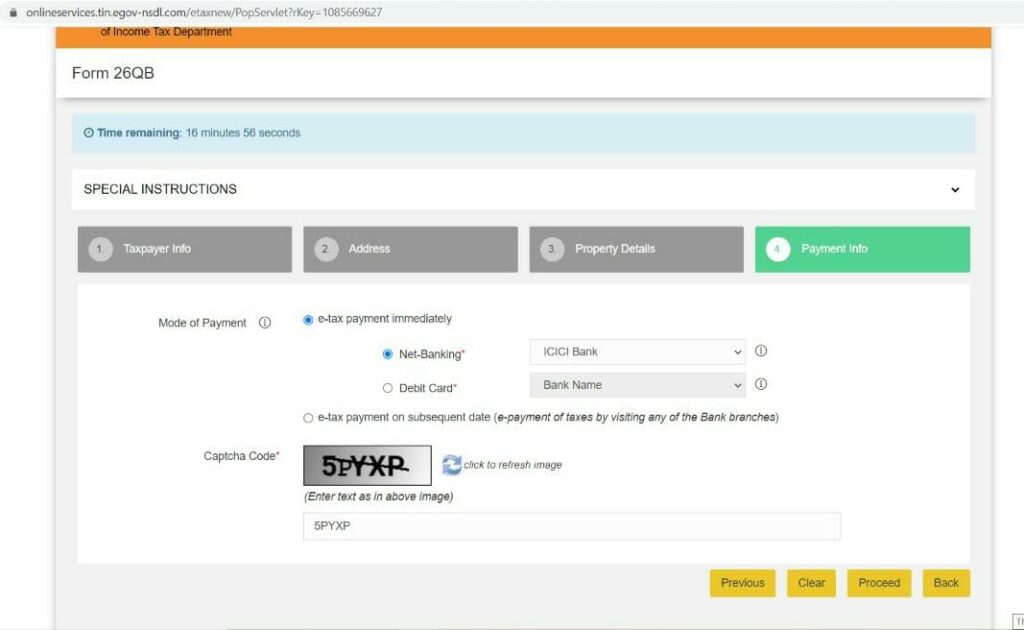

4. Payment of TDS: After filling all the details, there is selection option for payment of TDS:

a) E- Tax payment Immediately- If you want to pay challan at the same time through Net banking or debit card etc.

b) e-tax payment on subsequent date – If you want to generate challan and pay later by visiting any of the Bank branches.

5. Submit the duly filled form to proceed. A confirmation screen appears in which we can check filled details.

6. After confirming, a screen appears showing two buttons as “Print Form 26QB” and “Submit to the bank”.

6. A unique acknowledgement number is also displayed on the screen. It is advisable to save this acknowledgment number for future use.

7. Click on “Print Form 26QB” to print the form. Then click on “Submit to the bank” to make the required payment online through internet banking.

8. Then proceed to the payment page through internet banking facility of various banks. For list of authorized banks, please refer https://onlineservices.tin.egov-nsdl.com/etaxnew/Authorizedbanks.html

9. On successful payment a challan counterfoil will be displayed containing CIN, payment details and bank name through which e-payment has been made. This counterfoil is proof of payment being made.

II. Steps to Download Form 16B:

Proceed to TRACES portal( www.tdscpc.gov.in) after 5 days to download Form 16B.

- Register & login on TRACES portal ( www.tdscpc.gov.in) as taxpayer using your PAN.

- Select “Form 16B (For Buyer)” under “Downloads” menu.

- Enter the details pertaining to the property transaction for which Form 16B is to be requested. Enter the Assessment Year, Acknowledgment Number, PAN of Seller and click on “Proceed”.

- A confirmation screen will appear. Click on “Submit Request” to proceed.

- A success message on submission of download request will appear. Please note the request number to search for the download request.

- Click on “Requested Downloads” to download the requested files.

- Search for the request with request number. Select the request row and click on “HTTP download” button.