Clause 44 was notified vide CBDT Notification 33/2018 dated 20th August 2018 to be implemented for FY 2017-18 and onwards.

What includes clause 44?

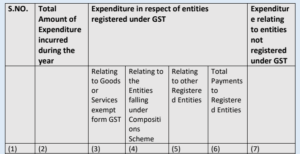

Clause 44 requires a taxpayer to provide a break-up of expenditures made to GST registered entities/Non-GST registered entities i.e Outgoing Expenses. Hence, disclosure in Clause 44 will be applicable to all the assessees who are subjected to tax audit u/s 44AB irrespective of the fact whether they are registered under GST or not.

ICAI Guidance Note

ICAI has recently issued new guidance notes effective from AY 2022-23 onwards. In that guidance notes, an explanation has been provided regarding reporting under clause 44 and related points. But there are still a few points regarding which we do not have any direct clarification.

Following are the important point in Guidance Note:

- The whole Expenditures including capital Expenditures i.e. purchases of Fixed Assets are to be given in consolidated form. No separate figures are required to be reported.

- Depreciation need not to be reported.

- Transactions which are covered under schedule III are not required to be reported under clause 44.

- Non-GST expenditures are to be bifurcated under “Exempted supply”.

Previous deferment of Clause 44

Clause 44 has been deferred in following year with notification No.

- FY 2017-18 vide circular 6/2018 dated 17th August 2018

- FY 2018-19 vide circular 9/2019 dated 14th May 2019

- FY 2019-20 vide circular 10/2020 dated 24th April 2020 & circular 05/2021 dated 25th March 2021

Format in which data can be collected for clause 44