A. What is E-Invoice?

‘E-invoicing’ facilitates exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format.

As per Rule 48(4) of CGST Rules, notified class of registered persons have to prepare E-invoice by uploading specified details of invoice (in FORM GST INV-01) on Invoice Registration Portal (IRP) and get an Invoice Reference Number (IRN)alongwith QR Code.

Please note that

• ‘E-invoice’ is not about invoice being in soft copy like PDF etc.

• ‘E-invoicing’ doesn’t mean generation of invoice by a government portal.

B. For who e-invoicing is mandatory?

E-invoicing is compulsory from 1st October 2020, to all the businesses whose aggregate turnover exceeds Rs. 500 crores in any financial year from 2017-2018 to 2018-2019.

It is also started too applicable on businesses whose aggregate turnover exceeds Rs. 100 crores in any financial year from 2017-2018 to 2019-2020 from 1st January 2021.

In addition to this from 1st April 2021 it is applicable to businesses with a total turnover of more than Rs. 50 crores.

However, irrespective of the turnover, E Invoicing is not applicable to the below registered personas notified in CBIC Notification No.13/2020 – Central Tax:

- An insurer or a banking company or a financial institution, including an NBFC

- A Goods Transport Agency (GTA)

- A registered person supplying passenger transportation services

- A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services

- An SEZ unit (excluded via CBIC Notification No. 61/2020 – Central Tax)

- A government department and Local authority (excluded via CBIC Notification No. 23/2021 – Central Tax)

C. Can an E-invoice be cancelled partially and full?

Yes. The cancellation request can be triggered through ‘Cancel API’ within 24 hours from the time of reporting invoice to IRP.

However, if the connected e-way bill is active or verified by officer during transit, cancellation of IRN will not be permitted. In case of cancellation of IRN, GSTR-1 also will be updated with such ‘cancelled’ status.

D. What documents are presently covered under e -invoicing?

- Invoices

- Credit Notes

- Debit Notes,

when issued by notified class of taxpayers (to registered persons (B2B) or for the purpose of Exports) are currently covered under e-invoice.

Though different documents are covered, for ease of reference and understanding, the system is referred as ‘e-invoicing’.

E. B2C (Business to Consumer) supplies can also be reported by notified persons?

No. Reporting B2C invoices by notified persons is not applicable/allowed currently. However, they will be brought under e-invoice in the next phase.

F. Is e-invoicing applicable for NIL-rated or wholly-exempt supplies?

No. In those cases, a bill of supply is issued and not a tax invoice.

G. Whether e-invoicing is applicable for supplies involving Reverse Charge?

If the invoice issued by notified person is in respect of supplies made by him but attracting reverse charge under Section 9(3), e-invoicing is applicable.

For example, a taxpayer (say, a Firm of Advocates having aggregate turnover in a FY is more than Rs. 500 Cr.) is supplying services to a company (who will be discharging tax liability as recipient under RCM), such invoices have to be reported by the notified person to IRP.

On the other hand, where supplies are received by notified person from (i) an unregistered person (attracting reverse charge under Section 9(4)) or (ii) through import of services, e-invoicing doesn’t arise / not applicable.

H. BENEFITS OF E-INVOICING:

There are some benefits of e-invoicing which is as follows:

1. The data under form GSTR-1 is all kept ready for filing while using e-invoicing system.

2. It helps in eliminating reporting in multiple formats as it generates invoices while one time reporting of B2B invoices.

3. With the use of e-invoice data you can also generate E-way bills.

4. There is minimum need for data settlement between books and GST returns which is filed.

5. It also eliminate the verification of Input Tax Credit issues.

6. It helps in better management and self-operating of the tax filing process.

7. E-invoicing can reduce the number of frauds as the access is also with the tax authorities. And,

8. Lastly it also eliminates the generation of fake GST.

Official Website for generate E-Invoice

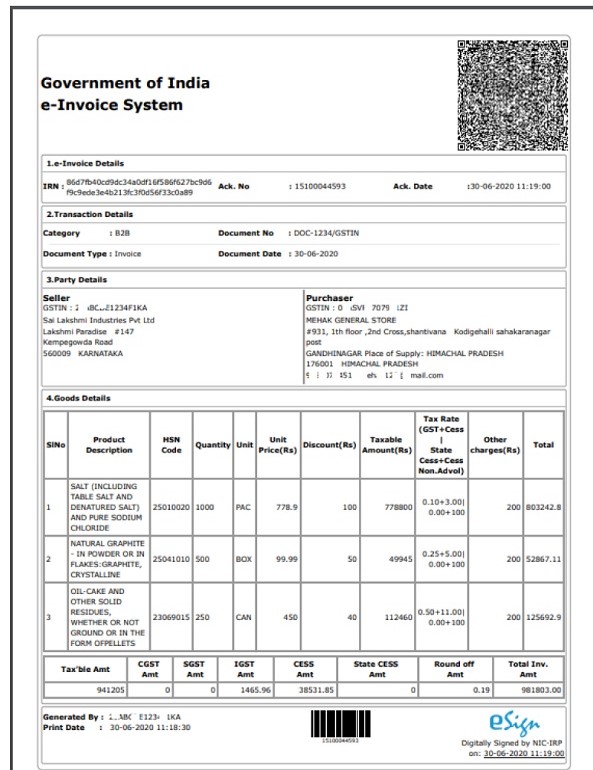

SAMPLE E-INVOICE PRINT (attached)